What are the key trends influencing how South African businesses deploy their impact funding, and how are these trends likely to evolve in 2026?

As an advisory business supporting organisations that invest in impact projects while managing commercial and reputational risk, this is a question we consider constantly when engaging with corporate partners.

One clear trend stands out.

South African businesses are increasingly shifting away from fragmented, once-off Corporate Social Investment (CSI) initiatives towards integrated, outcome-driven impact investments. These investments are designed to strengthen the systems businesses rely on, from infrastructure and skills pipelines to healthcare and digital access—while aligning social impact with long-term business strategy.

This marks a decisive move away from CSI as a compliance exercise and towards impact funding as a strategic lever.

From CSI to integrated impact investment

Traditional CSI has often taken the form of donations or short-term projects with limited ability to scale or deliver sustained outcomes. While well-intentioned, many of these initiatives struggled to demonstrate long-term value for either beneficiaries or funders.

In contrast, we are now seeing corporates structure their impact funding in ways that are measurable, investable and aligned with operational risk mitigation. This evolution benefits both South Africa’s development priorities and the businesses deploying the capital.

What is Corporate Social Investment (CSI)?

South Africa faces persistent social and economic challenges, many of which are intensified by constrained public finances and low economic growth.

In response, the private sector contributes billions of rands annually to support interventions across education, infrastructure, healthcare, youth employment and enterprise development.

As this level of investment has grown, so too has the expectation that CSI funding should be supported by:

- A clear theory of change

- Evidence of long-term impact

- Measurable economic and social outcomes

Depending on business objectives, impact funding is typically deployed across multiple channels, including:

- Corporate Social Investment (CSI)

- Enterprise and Supplier Development (ESD)

- Concessional or impact capital

- Grant funding from foundations or development partners

The lines between these channels are increasingly blurring as corporates seek more efficient and accountable deployment models.

A must-read on impact spend in South Africa

According to advisory firm Trialogue, South African businesses invested R13.1 billion in CSI-related projects in 2025, representing a 3% increase from the R12.7 billion invested in 2024.

The 2025 Trialogue Business in Society report highlights a clear shift in how impact capital is being allocated. Funding decisions are becoming more closely aligned with Environmental, Social and Governance (ESG) principles, while also addressing operational and reputational risks.

Corporates are increasingly favouring credible, well-structured projects—particularly in areas where they may lack internal expertise—and are turning to strategic advisors and deployment intermediaries to support this process.

The business community is no longer approaching impact funding purely as a budget line item. Instead, organisations are applying investment logic, assessing risk, return, scalability and sustainability alongside social outcomes.

A robust cost-benefit analysis has become central to project selection. Transparency around risk and realistic expectations of impact are now non-negotiable. Ultimately, businesses must remain commercially viable, and impact investments that ignore this reality are unlikely to succeed.

This is where the role of an experienced advisory partner becomes critical.

Why CSI and impact funding matter more than ever

One notable data point from the Trialogue research is the uneven recovery of CSI spend following the COVID-19 pandemic, with many organisations attempting to rebuild impact budgets in line with inflation rather than ambition.

By contrast, impact-aligned and ESG-driven investments offer the potential to reverse this stagnation by delivering deeper, more sustainable outcomes.

Approaching CSI with an investment mindset rather than a donation mindset materially changes how projects are structured, governed and evaluated. It also improves accountability to both beneficiaries and shareholders.

Key impact funding trends identified in 2025

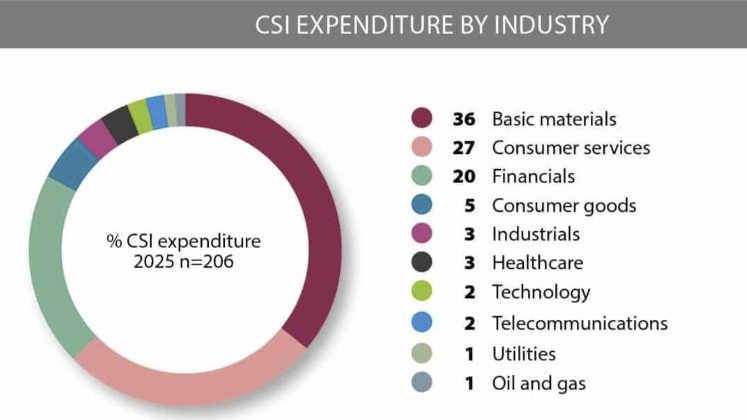

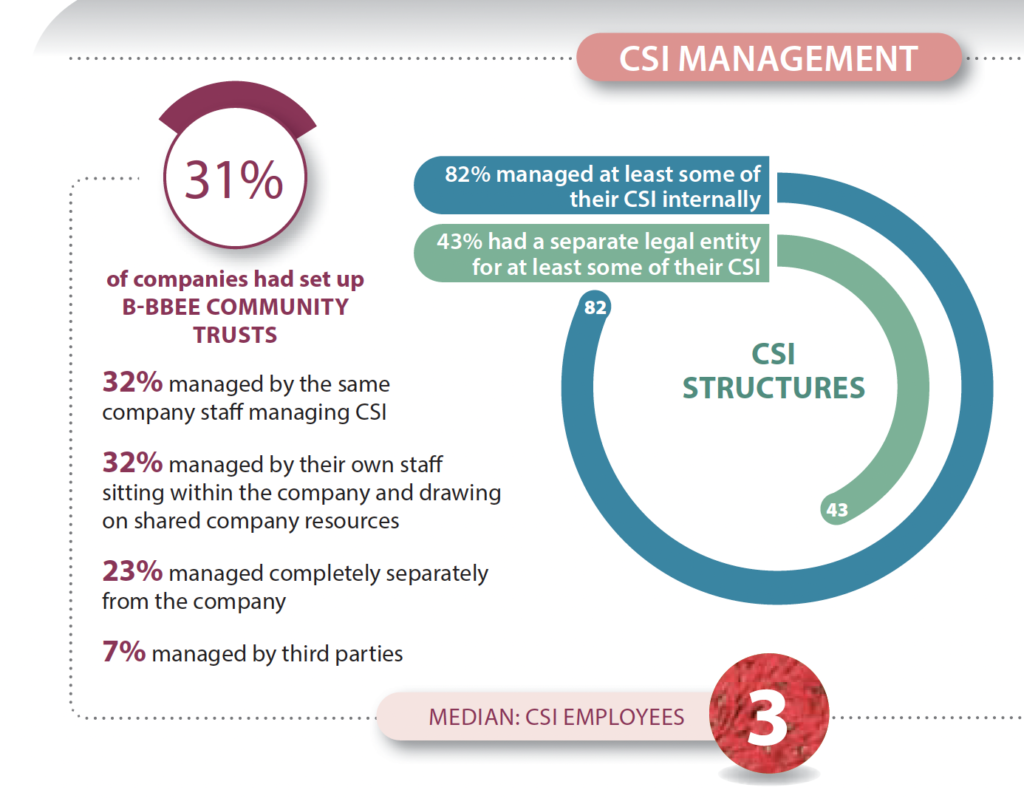

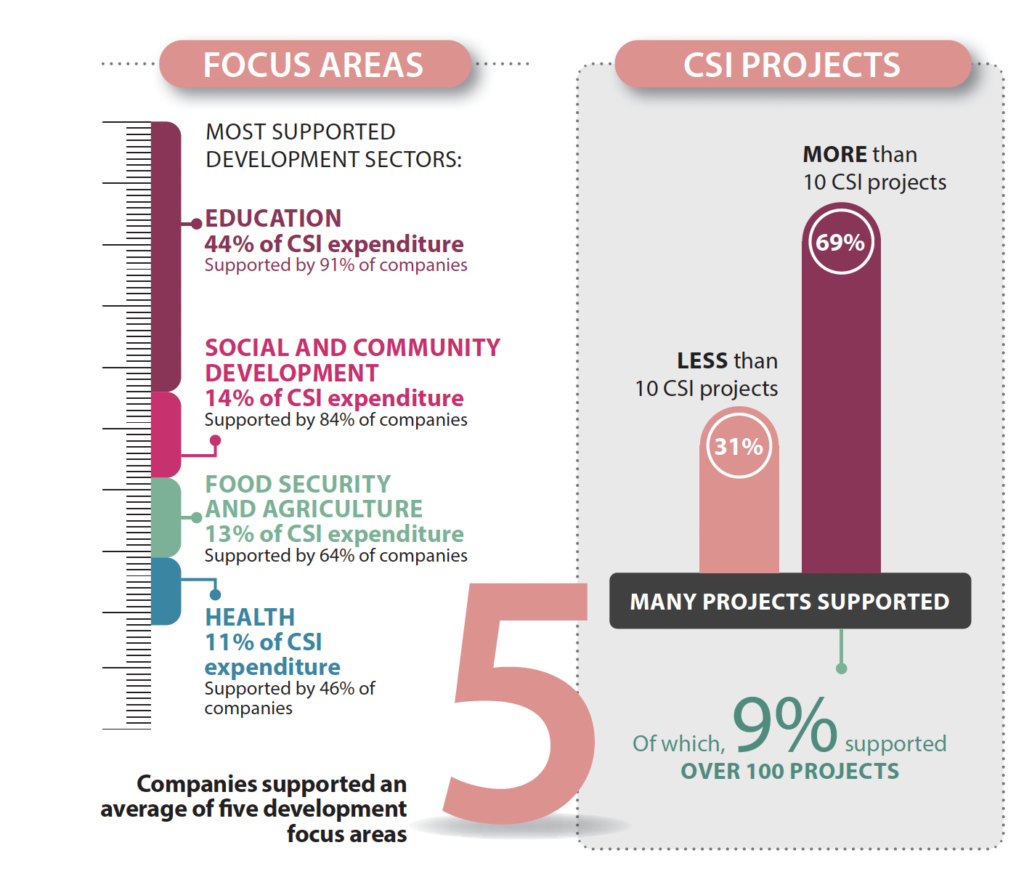

The Trialogue report provides valuable insight into how impact funding was deployed across industries and structures in 2025.

Key themes include:

- Variations in CSI spend by industry

- Increased use of structured funding vehicles

- Greater focus on priority impact areas aligned to national risk factors

See below the expenditure by industry, admin and funding structures and focus areas

Together, these insights reinforce the direction of travel: fewer fragmented projects, more strategic deployment.

Looking ahead: impact investment priorities for 2026

As South Africa enters 2026, we expect demand for innovative, scalable impact projects to accelerate—particularly those that blend CSI, ESD and other transformation funding.

Our pipeline for 2026 includes projects focused on:

- Deploying ESD and SED funding to recruit and place unemployed doctors

- Artisan training programmes supporting entrepreneurs aligned to infrastructure expansion

- Rolling out fibre infrastructure in under-served communities to enable digital inclusion

- Integrating the Youth Employment Service (YES) incentive into sustainable employment pathways

Each of these initiatives is supported by appropriate monitoring and evaluation (M&E) frameworks to ensure accountability and measurable outcomes.

Investing impact capital with confidence

If your organisation is reviewing how to deploy CSI, ESD or broader impact funding in 2026, our team is well positioned to support you.

We specialise in designing and implementing impact investment strategies that align commercial objectives with meaningful socio-economic outcomes. Our approach focuses on governance, risk mitigation and long-term sustainability, ensuring impact funding delivers value beyond compliance.

If you would like to explore how to invest your impact capital with confidence, reach out to us today.